Liquified Natural Gas (LNG) has seen an impressive growth in Europe in the past few years, with a 60% increase in imported volumes through 2022 compared to 2021. And as a consequence of the increased security of supply requirements resulting from the RepowerEU plan, that mandates the phase-out of Russian gas imports, it is only natural that many players started to look with increased attention at the development of new LNG infrastructures across Europe.

At DFC we have recently supported a gas shipper in the regulatory procedures and commercial design of a new Floating Storage and Regassification Unit (FSRU) for the import of LNG in South-Eastern Europe. The project entailed:

- Reviewing the application for exemption under Article 36 of Directive 2009/73/EC of the European Parliament and of the Council of 13 July 2009 concerning common rules for the internal market in natural gas (the “Gas Directive“) from the unbundling, third-party access and tariff regulation requirements (articles 9, 41 and 32 of the Gas Directive, respectively)

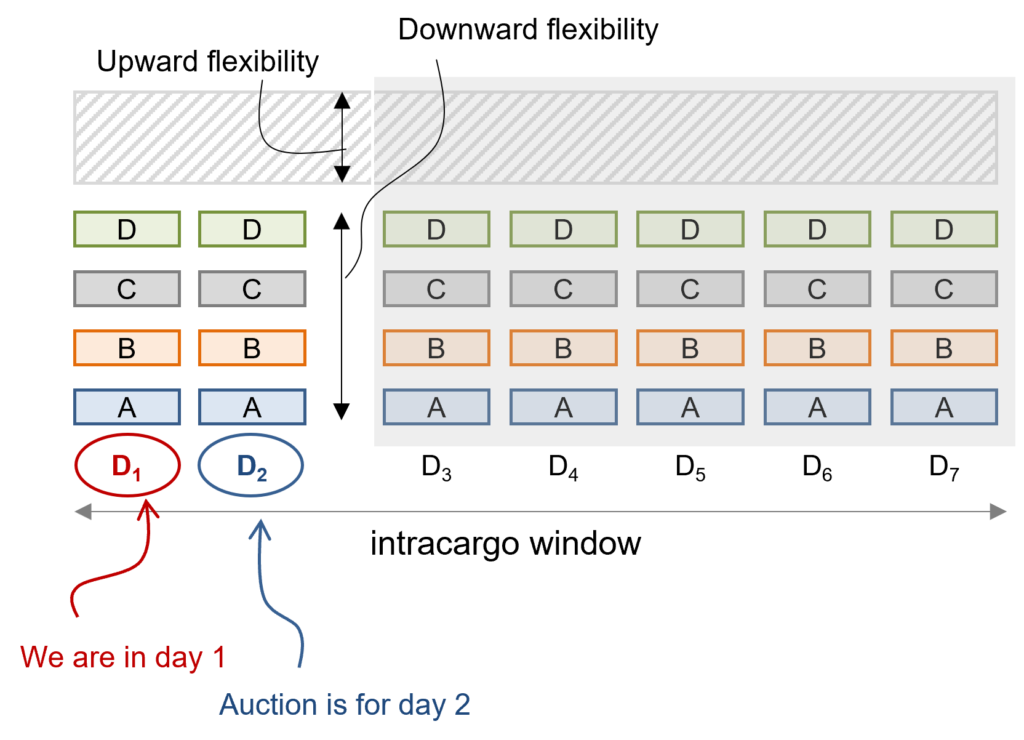

- Designing the products to be offered to third-party users. In particular, the product design takes the so-called ‘borrow-and-lending’ approach in which each gas shipper receives a share of the gas delivered at the terminal within a given time period, irrespective of the exact timing of unload of its cargoes. This design brings the benefit of increased flexibility for shippers in meeting their demand downestream, at the cost of increasing risk in case LNG is ‘lent’ but not ‘returned’ by any other user (see next point)

- Precisely to address the issue above, we designed a guarantee mechanism to protect users of the terminal against non-deliveries of other users

- Designing the allocation mechanism, based on non-discriminatory auctions for products with different granularity, and the nomination process

- Supporting the client in the interactions with potential users of the infrastructure